Page 5 - SSLSD IAL handbook

P. 5

5

Accounting

Content overview

In year 12, students will learn the principles of accounting and double entry bookkeeping, control

procedures, financial statements of organisations, introduction to costing, analysis of accounting

statements and social and ethical accounting.

In year13, students will learn financial reporting of limited companies, investment ratios, statement

of cash flows, budgeting, standard costing, project appraisal, break-even analysis marginal costing

and absorption costing and ICT in accounting

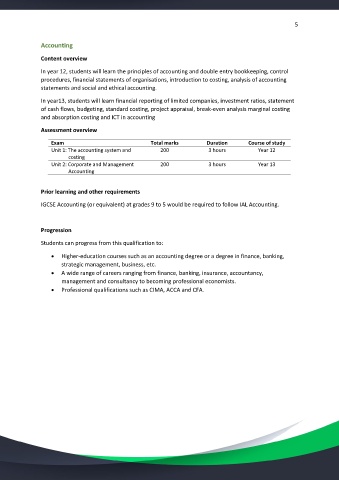

Assessment overview

Exam Total marks Duration Course of study

Unit 1: The accounting system and 200 3 hours Year 12

costing

Unit 2: Corporate and Management 200 3 hours Year 13

Accounting

Prior learning and other requirements

IGCSE Accounting (or equivalent) at grades 9 to 5 would be required to follow IAL Accounting.

Progression

Students can progress from this qualification to:

Higher-education courses such as an accounting degree or a degree in finance, banking,

strategic management, business, etc.

A wide range of careers ranging from finance, banking, insurance, accountancy,

management and consultancy to becoming professional economists.

Professional qualifications such as CIMA, ACCA and CFA.